Northern Power Women Shortlist

After hours of deliberating our outstanding 950 nominations, we are proud to announce our Northern Power Women’s Award Shortlist for 2018.

Congratulations to all nominees and good luck to our shortlist at the awards!

Aviva Community fund winners

Here so the link to the Aviva winners (Jan 2018).

See who has won here:

Budget 2017

This is a useful document from CIH on what you may want to know about the housing budget:

What you need to know about the Budget 2017

Inside Housing summarised the housing parts of Phillip Hammonds’ speech atas:

- Investment of £44bn in housebuilding in capital funding, loans and guarantees over the next five years to boost supply of skills, resources and land

- Commitment to be building300,000 homes a year by mid-2020s

- £1.5bn package of changes to Universal Credit announced. This includes the scrapping of the seven-day waiting period at the beginning of a claim, making a full month’s advance available within five days of a claim for those that need it and allowing claimants on housing benefit to continue claiming for two weeks

- Lift council borrowing caps in “high-demand areas”

- A £125m increase over two years in Targeted Affordability Funding for Local Housing Allowance claimants in the private sector struggling to pay their rent

- New money into Home Builders Fund

- Extra £2.7bn for Housing Infrastructure Fund

- Invest £400m in estate regeneration

- £1.1bn on unlocking strategic sites

- Stamp duty for first time buyers on properties worth up to £300k will be axed, while the first £300k on properties worth up to £500k will also be scrapped

- Three new Housing First pilots announced for West Midlands, Manchester and Liverpool

- Councils to be given the power to charge 100% council tax premium on empty properties

- Government will launch a consultation to barriers to longer tenancies in the private rented sector

- £28m for Kensington & Chelsea Council for mental health and counselling services, regeneration projects in areas surrounding Grenfell Tower and a new community space

- Invest in five new garden towns

- £125m increase in Targeted Affordability Funding for Local Housing Allowance claimants in the private sector struggling to pay rent.

Inside Housing – in detail summarised the budget as follows:

ON UNIVERSAL CREDIT AND WELFARE

The switch to Universal Credit is a long overdue and necessary reform.

Replacing a broken system that discouraged people from working more than 16 hours a week.

And trapped 1.4 million on out-of-work benefits for nearly a decade.

Universal Credit delivers a modern welfare system, where work always pays and people are supported to earn.

But I recognise the genuine concerns on both sides of the House about the operational delivery of this benefit.

Today we will act on those concerns.

First, we will remove the seven-day waiting period applied at the beginning of a benefit claim so that entitlement to Universal Credit will start on the day of the claim.

We have looked at reducing the delay at the end of the first month assessment period.

But to do so would mean compromising the principle of payments being made on the same day of the month.

A key feature of the system, which is very important for claimants in managing their budgets.

So to provide greater support during the waiting period we will change the advances system to ensure that any household that needs it can access a full month’s payment within five days of applying.

We will make it possible to apply for an advance online.

And we will extend the repayment period for advances from six months to 12 months.

Any new Universal Credit claimant in receipt of Housing Benefit, will continue to receive it for two weeks.

This is a £1.5bn package to address concerns about the delivery of the benefit.

My right honourable friend the secretary of state for work and pensions will give further details in a statement to the House tomorrow.

Mr deputy speaker.

We also want to help low-income households in areas where rents have been rising fastest.

In the long term, the answer lies in increasing the amount of housing available – a theme I shall return to.

But in the meantime, the best way to help them is by increasing the rate of support in those areas where rents are least affordable.

So we will increase Targeted Affordability funding by £125m over the next two years, benefitting 140,000 people.

We will always listen to genuine concerns, and act where we can to help.

ON GRENFELL AND FIRE SAFETY

I want to touch on the aftermath of the appalling events at Grenfell Tower.

We have provided financial support for the victims of this terrible tragedy.

“All local authorities and housing associations must carry out any identified necessary safety works as soon as possible”

And today I can announce we will provide Kensington and Chelsea Council with a further £28m for mental health services, regeneration support for the surrounding areas and to provide a new community space for Grenfell United community group.

This tragedy should never have happened and we must ensure that nothing like it ever happens again.

All local authorities and housing associations must carry out any identified necessary safety works as soon as possible.

If any local authority cannot access funding to pay for essential fire safety work, they should contact us immediately.

As I have said before, we will not let financial constraints get in the way of essential safety work.

ON EMPTY HOMES AND ROUGH SLEEPING

I want to address the issue of empty properties:

It can’t be right to leave property empty when so many are desperate for a place to live.

So we will give local authorities the power to charge a 100% council tax premium on empty properties.

“It is unacceptable that in 21st-century Britain there are people sleeping on the streets.”

We will also launch a consultation on barriers to longer tenancies in the private rented sector, and how we might encourage landlords to offer them to those tenants who want the extra security.

And I want to say something about rough sleeping.

It is unacceptable that in 21st-century Britain there are people sleeping on the streets.

So we’ll invest £28m in three new “Housing First” Pilots in the West Midlands, Manchester and Liverpool.

And establish a homelessness taskforce.

As part of our commitment to halving rough sleeping by 2022, and eliminating it by 2027.

ON HOUSEBUILDING

I’d like to thank the many colleagues who submitted ideas on how to tackle the challenge of the housing market.

Including honourable friends for North East Hampshire, Eastleigh, and Weston-Super-Mare.

By continuing to invest in Britain’s infrastructure, skills and R&D we will ensure the recovery in productivity growth that is the key to delivering our vision of a stronger, fairer, more balanced economy.

And the assurance to the next generation of their economic security.

But however successful we are in that endeavour, there is one area where young people today will, rightly, feel concern about their future prospects – and that is in the housing market.

House prices are increasingly out of reach for many.

It takes too long to save for a deposit.

And rents absorb too high a portion of monthly income.

So the number of 25-34-year-olds owning their own home has dropped from 59% to just 38% during the past 13 years.

Put simply, successive governments over decades, have failed to build enough homes to deliver the home-owning dream that this country has always been proud of.

Or, indeed, to meet the needs of those who rent.

In Manchester a few weeks ago, my right honourable friend the prime minister made a pledge to Britain’s younger generation that she would “…dedicate [her] premiership to fixing this problem”.

Today we take the next steps to delivering on that pledge.

By choosing to build.

“Solving this challenge will require money, planning reform and intervention”

We send a message to the next generation that getting on the housing ladder is not just a dream of your parents’ past.

But a reality for your future.

We’ve made a start with schemes like Help to Buy, which has helped more than 320,000 people buy a home.

We’ve increased the supply of homes by more than 1.1 million since 2010.

Including nearly 350,000 affordable homes.

Housebuilding stands at its highest level since the financial crash, with the latest figures showing that over 217,000 net additional homes were added to the stock last year.

That is a remarkable achievement.

But we need to do better still if we are to see affordability improve.

This is a complex challenge.

There is no single magic bullet.

If we don’t increase supply of land for new homes, more money will inflate prices, and make matters worse.

If we don’t do more to support the growth of the SME housebuilding sector.

[Political content removed]

We will remain dependent on the major national housebuilders that dominate the industry.

And if we don’t train the construction workers of tomorrow.

We may generate planning permissions, but we will not turn them into homes.

Solving this challenge will require money, planning reform and intervention.

So today we set out an ambitious plan to tackle the housing challenge.

During the next five years we will commit a total of at least £44bn of capital funding, loans and guarantees to support our housing market.

To boost the supply of skills, resources and building land.

And to create the financial incentives necessary to deliver 300,000 net additional homes a year on average by the mid-2020s.

The biggest annual increase in housing supply since 1970.

New money for the Home Builders Fund to get SME housebuilders building again.

A £630m small sites fund to unstick the delivery of 40,000 homes.

A further £2.7bn to more than double the Housing Infrastructure Fund.

£400m for estate regeneration.

A £1.1bn fund to unlock strategic sites, including new settlements and urban regeneration schemes.

A lifting of HRA caps for councils in high-demand areas to get them building again.

And £8bn of new financial guarantees to support private housebuilding and the purpose-built private rented sector.

And because we need a workforce to build these new homes.

We are providing an additional £34m to develop construction skills across the country.

“In London alone, there are 270,000 residential planning permissions unbuilt.”

Mr deputy speaker.

Solving the housing challenge takes more than money.

It takes planning reform.

We will focus on the urban areas where people want to live and where most jobs are created.

Making best use of our urban land, and continuing the strong protection of our green belt.

In particular, building high-quality, high-density homes in city centres and around transport hubs.

And to put the needs of our young people first, we will ensure that councils in high demand areas permit more homes for local first-time buyers and affordable renters.

My right honourable friend the communities secretary will set out more detail in due course.

However, one thing is very clear: there is a significant gap between the number of planning permissions granted and the number of homes built.

In London alone, there are 270,000 residential planning permissions unbuilt.

We need to understand why.

So I am establishing an urgent review to look at the gap between planning permissions and housing starts.

It will be chaired by my right honourable friend for West Dorset.

And will deliver an interim report in time for the Spring Statement next year.

“Infrastructure to facilitate higher density development must be funded and delivered.”

And if it finds that vitally needed land is being withheld from the market for commercial, rather than technical, reasons.

We will intervene to change the incentives to ensure such land is brought forward for development.

Using direct intervention compulsory purchase powers as necessary.

Mr deputy speaker, my right honourable friend the prime minister has said we will fix this problem.

And no one should doubt this government’s determination to do so.

But the solution will not deliver itself.

Local authorities will need help and support.

Developers will need encouragement and persuasion.

Infrastructure to facilitate higher density development must be funded and delivered.

So the Homes and Communities Agency will expand to become “Homes England”.

Bringing together money, expertise, and planning and compulsory purchase powers.

With a clear remit to facilitate delivery of sufficient new homes, where they are most needed, to deliver a sustained improvement in affordability.

But Mr deputy speaker, the battle to achieve and sustain affordability will be a long-term one.

So we also need to look beyond this parliament, to long-term measures.

We will use New Town Development Corporations to kick-start five new locally agreed garden towns in areas of demand pressure.

Delivered through public-private partnerships designed to attract long-term capital investment from around the world.

“We also need to look beyond this parliament, to long-term measures”

Last week the National Infrastructure Commission published its report on the Cambridge-Milton Keynes-Oxford corridor.

Today we back its vision and commit to building up to 1 million homes by 2050.

Completing the road and rail infrastructure to support them.

And as a down-payment on this plan, we have agreed an ambitious Housing Deal with Oxfordshire to deliver 100,000 homes by 2031.

Capitalising on the global reputations of our two most-famous universities…

And Britain’s biggest new town,

To create a dynamic new growth corridor for the 21st century.

Mr deputy speaker,

This is our plan to deliver on the pledge we have made to the next generation.

That the dream of home ownership will become a reality in this country once again.

ON HOMEOWNERSHIP

But I also want to take action today to help young people who are saving to own a home.

One of the biggest challenges facing young first-time buyers is the cash required up front.

“The dream of home ownership will become a reality in this country once again”

We have put £10bn more money into Help to Buy equity loan to help those saving for a deposit.

But I want to do more still.

I’ve received representations for a temporary stamp duty holiday to first-time buyers.

But that would only help those ready to purchase now.

And would offer nothing for the many who will need to save for years.

So, with effect from today, for all first-time buyer purchases up to £300,000, I am abolishing stamp duty altogether.

To ensure that this relief also helps first-time buyers in very high-price areas such as London, it will also be available on the first £300,000 of the purchase price of properties up to £500,000.

Meaning an effective reduction of £5,000.

A stamp duty cut for 95% of all first-time buyers who pay stamp duty.

And no stamp duty at all for 80% of first-time buyers from today.

Mr deputy speaker.

When we say we will revive the home-owning dream in Britain.

We mean it.

We do not underestimate the scale of the challenge

But today, we have made a substantial downpayment.

This speech was given by Philip Hammond, chancellor of the Exchequer, on 22 November.

CfPS National Scrutiny Conference

CfPS’s national scrutiny conference for local government was held on 6 December and focused on the theme of the governance of complexity. This online report provides an overview of the day and some feedback from participants, Presentations and associated notes from the conference can be found here.

CLG report on the state of scrutiny

The Communities and Local Government Select Committee published its report on the current state of scrutiny.

Its findings included that scrutiny is often marginalised, under resourced and lacks parity with other council functions. The report makes a series of recommendations to deliver culture change in local authorities to ensure that scrutiny is independent, respected,and well-resourced in the future.

The full report is available here.

Advice on avoiding disrepair claims

Thanks to Croftons Solicitors and Inside Housing for sharing this advice.

Some HAs have evidence of firms pretending to work for them, this is a worrying trend and money we can ill afford.

Check and remind your neighbours to check the credentials of those visiting your home!

1. Keep good records

Poor record-keeping is the largest evidential failure for landlords and makes easy pickings for tenant lawyers.

“The tenant won’t let us in” or “we did carry out that repair” are irrelevant arguments without the evidence to back them up. I’ve dealt with many a frustrated landlord who cannot prove their case and has had to reluctantly pay compensation.

Recording systems must be comprehensive and used effectively, with all contact with each tenant being recorded. It’s also extremely important that a detailed record of every repair is taken – differentiating between similar repair jobs could be crucial to a successful defence.

2. Don’t over-commit

The Landlord and Tenant Act obliges landlords to keep their homes “in repair”, but tenancy agreements often bind housing associations beyond this statutory – and objective – remit.

“What is classed as good repair? The answer would be down to a judge in a courtroom.”

For example, a simple variance to keep a home in “good repair” binds landlords to a subjective standard of repair, and clarity of defence is immediately lost.

What is classed as good repair? The answer would be down to a judge in a courtroom, subsequently litigating with a high risk that either party could lose their arguments.

Changing existing tenancy agreements isn’t a quick job as tenant consultation is needed, but it’s the only sure-fire way of resolving this issue.

3. Fit-for-purpose policies

Many clients have policies and procedures that are inadequate for avoiding successful disrepair claims – access procedures being a prime example.

Landlord liability doesn’t stop because your tenant wasn’t there to let you in, but many housing associations operate on the basis that if a repair contractor makes one failed access attempt, they simply leave a calling card and the onus is on the tenant to rearrange.

This is insufficient, as it does not relieve the landlord of their legal duty to repair. Refusing access is a tenancy breach and should be legally enforced. If all else fails, seek an injunction.

4. Training and awareness

Much of this boils down to good housing management – but that requires co-ordination between and awareness across repairs, customer service and tenancy management teams.

It’s crucial to provide cross-departmental training on the issues surrounding disrepair, and preventative measures such as thorough record-keeping, logging customer contact and following policies and procedures accurately.

Only by patching up these operational weaknesses will landlords be better able to successfully defend unsubstantiated claims, and only compensate tenants who have genuinely been aggrieved.

Rebecca Aspin, solicitor, Croftons Solicitors

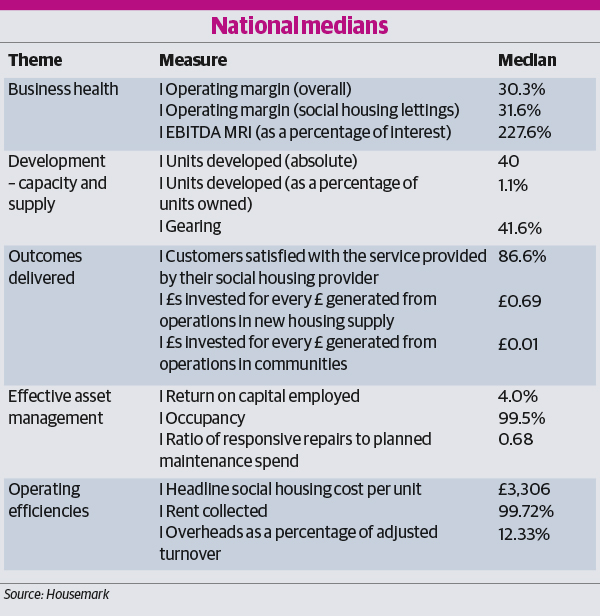

Sector score card medians

Here is the overall results from the sector score card which you can use to compare your landlords performance on VFM with other landlords and businesses

RLA comment to government on fire safety

The Residential Landlords Association (RLA) want government to improve systems that point out an individual with responsibility for fire safety.

Reported in 24 Housing:

“Residents in high rise blocks of flats are being let down by a system in which it is hard to hold to account a single person or organisation for fire safety measures, they said. At present responsibilities for various aspects of fire safety are shared between the owners of a block, the fire services, the local authority and the owner of individual flats. Such a situation risks important fire safety improvements not being taken as a result of confusion about responsibilities for carrying them out. The concern comes as part of the RLA submission to the Government’s building regulation review, led by Dame Judith Hackitt, following the tragic events at Grenfell Tower.

The RLA is calling for a new system that means for every residential building there is a single identifiable person who should be responsible for assessing and overseeing fire safety measures.

Such individuals, the RLA argues, should be supported by the creation of a new fire safety compliance code to make sure others involved with the building, such as occupiers, play their part.

This should be backed up by ensuring that there is one enforcement body on fire safety measures, a responsibility that is currently split between local councils and the fire service.

Overall, this system would improve accountability and address the risk that fire safety responsibilities fall through the cracks between different authorities and individuals. In its submission the RLA warns that contradictory and outdated fire safety guidance needs updating to better support good landlords. At present, landlords are expected to abide by fire safety guidance which was issued by LACORS, a body that no longer exists, fire safety regulations that date back to 2005 and building regulation guidance issued in 2006. This is in addition to guidance published in 2006 which covers the Housing, Health and Safety Rating System (HHSRS), used by councils to assess risks in dwellings.

Confusingly, the existing smoke detector regulations suggest a lower standard for detection and fire alarms for various properties than that which is in fact needed under this Guidance. This is one example of the contradictions under the current regime”

Deregulation limiting council control on HAs will impact on around 100 HAs

Deregulation measures forming part of the package aimed at moving housing associations back into the private sector have been passed unanimously by a parliamentary committee.

“The draft bill, which is being put through as an affirmative statutory instrument – meaning it cannot be amended – went before a legislation committee.

The government estimates that the new measures, aimed at limiting local authority control over associations formed out of stock transfers, will affect around 100 housing associations around the country.

Housing minister Alok Sharma told the committee: “Housing associations need a stable investment environment in which they can play their part in fixing the housing market and get on with building new homes. The fact that they are classified as public sector for the purpose of technical accounting is providing an unnecessary distraction.” ”